Renting vs. Buying Property in the UAE: Pros and Cons

For those living in the UAE, one of the biggest decisions is whether to rent or buy a property in the UAE. Both options have their advantages and disadvantages, and the right choice depends on individual circumstances and goals. In this blog post, we’ll explore the key pros and cons of renting versus buying to […]

For those living in the UAE, one of the biggest decisions is whether to rent or buy a property in the UAE. Both options have their advantages and disadvantages, and the right choice depends on individual circumstances and goals. In this blog post, we’ll explore the key pros and cons of renting versus buying to help you make an informed decision.

Pros of Renting a Property in the UAE

Flexibility: One major benefit of renting is the flexibility it provides. With a rental property, you’re not tied down long-term, allowing you to move more easily when your circumstances change or a better opportunity arises elsewhere. This flexibility is particularly valuable for expatriates or those unsure about their long-term plans in the UAE.

Avoid Large Upfront Costs: Renting eliminates the need for a substantial down payment and closing costs associated with purchasing a property. This can free up significant funds for other investments or expenses.

Maintenance Covered: As a renter, you’re not responsible for the maintenance and repair costs that come with homeownership. Any issues are typically handled by the landlord, saving you time, effort, and money.

Cons of Renting a Property in the UAE

No Ownership Equity: Perhaps the biggest downside of renting is that you’re not building any equity or ownership stake in the property. The money paid in rent essentially goes toward someone else’s investment rather than your own.

Lack of Renovation Freedom: Renters generally can’t make major renovations or modifications to the property without the landlord’s approval. This limits your ability to personalize the living space to your preferences.

Potential Rent Increases: Landlords can increase the rent at the end of each lease term, leading to higher housing costs over time. This lack of long-term cost stability can impact your budget planning.

Pros of Buying a Property in the UAE

Build Home Equity: When you purchase a property, a portion of each mortgage payment goes toward building equity – an ownership stake that can be leveraged or recouped when selling. This equity accumulation is a form of forced savings and wealth creation.

Renovation Freedom: As a homeowner, you have the freedom to renovate, remodel, or make any desired changes to the property without needing approval from a landlord.

Stable Housing Costs: Once the mortgage is paid off, your primary housing expenses become just the recurring costs like utilities and maintenance. This long-term cost stability can provide financial security.

Cons of Buying a Property in the UAE

Large Upfront Costs: Purchasing a property requires a substantial down payment, often 20-25% of the home’s value. There are also closing costs and fees to consider.

Responsibility for Maintenance: As a homeowner, you’re solely responsible for all maintenance, repairs, and potential home improvements needed over time. These costs can add up quickly.

Reduced Mobility: Selling a property can be a lengthy and expensive process, making it more difficult to relocate quickly for job opportunities or other reasons compared to simply terminating a rental lease.

How Smoove Helps with Moving

Whether you decide to rent or buy a property in the UAE, Smoove can make your moving experience smooth and hassle-free. As the UAE’s leading online platform for moving services, Smoove connects you with top-rated and affordable movers across all emirates.

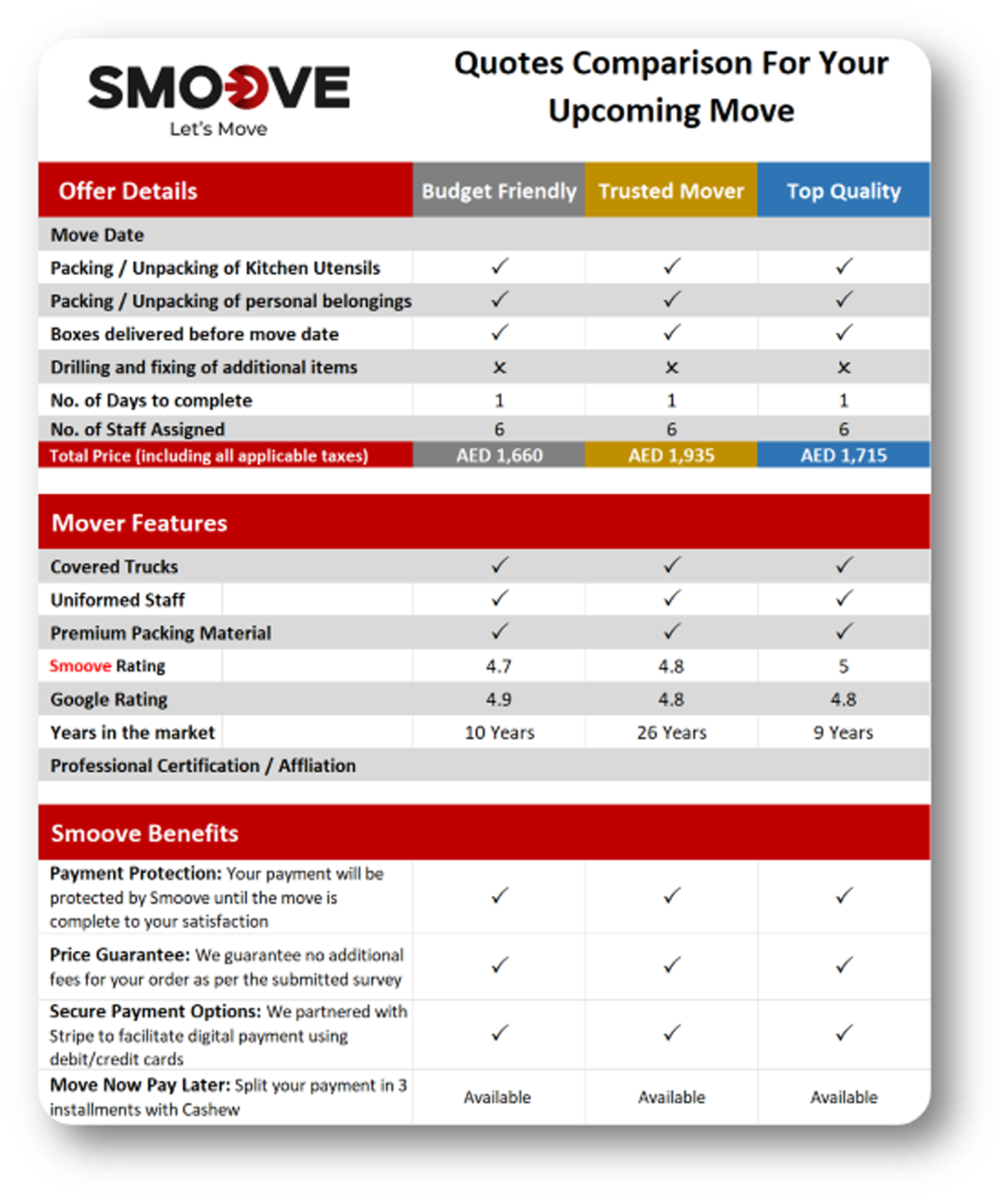

With Smoove, you can easily compare quotes from multiple trusted moving companies, read customer reviews, and book the best service for your needs and budget – all in one convenient place. Their comprehensive solutions cater to residential and office moves, providing packing, loading, transportation, and even storage if required.

By leveraging Smoove’s innovative platform and network of reliable movers, you can ensure a stress-free transition to your new rental home or purchased property in the UAE.